Tax Exemption

1. Please include the following information in your certificate to qualify for tax-exemption:

- Valid Certificate

Make sure the certificate is active. Your tax-exempt request will be processed after we have verified that the certificate is valid.

- Vendor Info

Super Micro Computer, Inc.

980 Rock Ave.

San Jose, CA 95131 - List Purchase Items (If applicable)

- List Reasons for Tax Exemption (If applicable)

- Signature and Date

Please make sure the date on the certificate is either prior to or on the day of purchase.

2. Please send your certificate to estore-support@supermicro.com.

*You may be asked to provide more information for approval. Please make sure you provide all sufficient information in the same month of purchase.

3. How long does the tax-exempt process take?

It usually takes up to 10 business days for the tax amount to be returned back to your original form of payment.

*It’s important to provide correct information in checkout process.

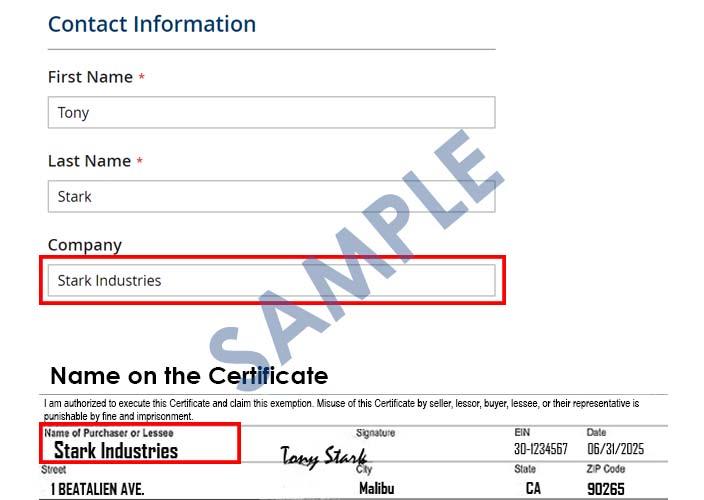

1. Billing Information (Sold-to-company)

- Please make sure the "Company" name matches the name on the certificate.

1. Your tax-exempt request may be rejected for the following reasons:

- Name on the certificate is inconsistent to billing (Sold-to-company) information – see ‘Billing Information’ tab.

- Failure to meet the tax-exempt application deadline.

- Invalid or inactive certificate.

- Other – Our support team will provide further information on how to gain approval

2. Can I remove the tax amount prior to making the purchase so I don’t have to pay tax?

No, the tax-exempt request will take place after the order has been placed. The tax amount will be refunded to the original form of payment.

3. Do you keep tax exempt information on record when we check out or in “My Account” for future purchases?

We do not keep any tax exempt information on record so you may be asked to provide a tax exempt certificate to apply the tax exempt again.

4. Does Supermicro charge tax?

Supermicro charges tax in AL, AR, AZ, CA, CO, CT, DC, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA , MA, MD, ME , MI, MN, MO, MS, NC, ND, NE, NJ, NM, NV, NY, OH, OK, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, WY.

5. Does Supermicro charge tax on shipping?

Supermicro charges tax in shipping in AL, AR, AZ, CA, CO, CT, DC, FL, GA, HI, IL, IN, KS, KY, LA, MD, ME, MI, MN, MO, MS, NC, ND, NE, NJ, NM, NV, NY, OH, PA, RI, SC, SD, TN, TX, VA, VT, WA, WI, WV.